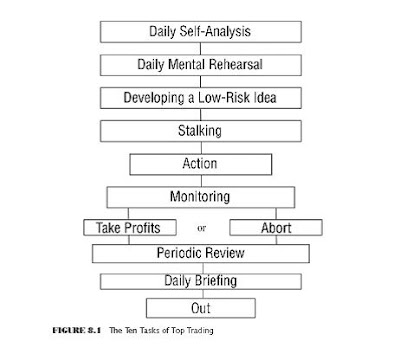

1. Daily Self-Analysis Successful trading is 40% risk control and 60% self-control. In turn, the risk control portion is one half money management and one half market analysis. Thus, market analysis is only about 20% of successful trading.

1. Daily Self-Analysis Successful trading is 40% risk control and 60% self-control. In turn, the risk control portion is one half money management and one half market analysis. Thus, market analysis is only about 20% of successful trading.Numerous people find that their best trades are the hardest trades to take. You generally go against the crowd in the best trades. As a result, when most people believe you are wrong with enough conviction to be in the market, and you’re around a lot of them, it’s very hard to go against them. As a result, people who trade in a crowd perceive their good trades to be “hard

trades.” Let’s assume that for you the hard trades are the big winners. How do you know if a trade is hard, or whether you are simply not in the mood to trade? You don’t. Self-analysis allows you to distinguish between the “hard” trade and those times when you make the trade seem hard.

6. Monitoring,The worst mistake that one can make during the monitoring phase is to rationalize and distort data according to expectations. The purpose of monitoring the market is to pay attention to market signals. The trader who interprets signals according to his expectations is not performing this task adequately.

9. Daily Debriefing

• First, avoid self-recrimination—telling yourself that you “should have” done this or you “could have” done that. Instead, resolve not to repeat that mistake again.

• Second, replay the trade in your mind. Prior to making that mistake, you reached a choice point. At that choice point, you had a number of options available to you.

• Third, mentally go back in time to that choice point and review you options.

• Fourth, for each possible option, determine what the outcome would be if you had taken it. Be sure that you give yourself at least three good choices and mentally rehearse them. Some generals are known for fighting the strategies of the last war. Those who do usually lose the battle. Always give yourself as many choices as possible, so that you don’t get stuck with limited options or a forced choice.

• Fifth, once you’ve found at least three options with favorable outcomes, mentally rehearse carrying them out in the future when you encounter similar situations. Once you’ve practiced them in your mind, you will find that selecting one of them is easy when you encounter

a similar situation in the future.

No comments:

Post a Comment