CapitalLand ** - Long if price closed above 6.60, Target 7.00, support at 6.25.

CapitalMall ***- Short if price closed below 3.28 , Cut loss at 3.45.

CityDiv ** - Long if price closed above 11.50, Targe 12.50, Cut loss at 11.24.

COSCO - Neutral.

DBSbank - Neutral.

F&N * - Long if price closed above 5.0, cut loss at 4.86.

GenInt ** - Short if intra day price out of BB by min 1 cents, target profit 1 cents.

HKL - Neutral.

Jardince ** - Long at price near to the cut loss price of 16.32 with good risk and Rewards ratio.

JSH - Neutral.

Kep Corp - Neutral.

Kep Land - key support at 5.25, long if MACD turn up.

Noble ** - Short if intra day price out of BB by min 10 cents, target profit 10 cents.

NOL ** - Short if intra day price out of BB by min 10 cents, target profit 10 cents.

OCBC - Neutral.

Olma ** - Short if intra day price out of BB by min 10 cents, target profit 10 cents.

SIA - Neutral.

Semb co - Neutral.

SemdM - Neutral.

SGX - Neutral.

SIA Eng - Neutral.

Singtel * - Long near to th cut loss price 3.69, Target 3.90.

SPH - Neutral.

ST Eng - Neutral.

UOB** - Long near to th cut loss price 19.85, Target 20.45.

Wilmar ** - Short if intra day price out of BB by min 15 cents, target profit 10 cents.

YZJ - Neutral.

Yanlord -Neutral.

It’s not what happens to you, it’s how you react to what happens to you that determines success or failure.

Success In Trading

Success in trading is all about consistency and to achieve that we must follow the golden rules.

These are:

1 Only take the best opportunities.

2 Always minimize risk. Taking only low risk

opportunities is part of this.

3 Use good Money Management.

4 Have the discipline to follow these rules, especially the first one. It is all too easy to get over-confident and take anything you see. You soon lose your shirt that way. “Only the best is good enough for our trading!”is a good motto to follow.

You can’t learn how to do it without doing it.

These are:

1 Only take the best opportunities.

2 Always minimize risk. Taking only low risk

opportunities is part of this.

3 Use good Money Management.

4 Have the discipline to follow these rules, especially the first one. It is all too easy to get over-confident and take anything you see. You soon lose your shirt that way. “Only the best is good enough for our trading!”is a good motto to follow.

You can’t learn how to do it without doing it.

Saturday, May 31, 2008

Friday, May 30, 2008

Thursday, May 29, 2008

Wednesday, May 28, 2008

Tuesday, May 27, 2008

Thursday, May 22, 2008

Wednesday, May 21, 2008

Tuesday, May 20, 2008

Monday, May 19, 2008

Saturday, May 17, 2008

Thursday, May 15, 2008

Wednesday, May 14, 2008

Tuesday, May 13, 2008

Monday, May 12, 2008

Sunday, May 11, 2008

Saturday, May 10, 2008

Mebtal State

The following six methods will help you gain control of your mental state and increase your success in following through on your trades.

1. Re-presenting the outside world to yourself.

To avoid playing a loser’sgame, it is essential to use the ‘right’ brain to see reality in time to avoid tragedy.” Our logical left hemisphere of the brain is simply not adept at

dealing with incomplete or partial information; indeed, the left hemisphere interferes by sticking new data into already established categories, and if the data do not fit, then the left mode, our dominant mode, tends to ignore them. Moreover, our left hemisphere, educated as it is in our Western culture, tends not to challenge assumptions.

Here is how she suggests you might subjectively experience an Rmode

state of consciousness:

Let’s review the characteristics of the R-mode one more time. First, there is a seeming suspension of time. You are not aware of time in the sense of marking time. Second, you pay no attention to spoken words. You may hear the sounds of speech, but you do not decode the

sounds into meaningful words. If someone speaks to you, it seems

as though it would take a great effort to cross back, think again in words, and answer. Furthermore, whatever you are doing seems immensely interesting. You are attentive and concentrated and feel “at one” with the thing you are concentrating on. You feel energized

but calm, active without anxiety. You feel self-confident and capable of doing the task at hand. Your thinking is not in word but in images and, particularly while drawing, your thinking is “locked on” to the object you are perceiving. The state is very pleasurable. On leaving it, you do not feel tired, but refreshed.

Our job now is to bring this state into clearer focus and under greater conscious control, in order to take advantage of the right hemisphere’s superior ability to process visual information and to

increase your ability to make the cognitive shift to R-Mode at will.

2. Changing your physical self.

3. Calling upon your own resources.

The following eight steps are a guide to implementing the resource

strategy.

1. Establish the context that prevents you from responding appropriately (for example, being caught in a losing trade). Identify the trigger (words, tone, analogue, and so on) for the nonproductive state (regret, anger, bad self-talk). Identify a specific example of a situation

(perhaps the last bad trade).

2. Associate into the situation at the point when you first realize you are having the undesired response (for example, see the stock tick downward on your computer screen).

3. Dissociate from the situation (literally step back from the screen).

4. Identify the most appropriate response(s) for the “other you over there” (for example, reframe the trade from “good” to “bad”; become fearful of it becoming worse).

5. Reassociate back into the situation, taking with you the new responses.

6. Future-pace (see yourself in the future exiting bad positions).

7. Test using a different but similar situation to the one previously tested.

8. Identify the most appropriate response(s).

4. Fantasizing.

5. Analyzing and integrating parts of yourself.

6. Modeling yourself after others.

1. Re-presenting the outside world to yourself.

To avoid playing a loser’sgame, it is essential to use the ‘right’ brain to see reality in time to avoid tragedy.” Our logical left hemisphere of the brain is simply not adept at

dealing with incomplete or partial information; indeed, the left hemisphere interferes by sticking new data into already established categories, and if the data do not fit, then the left mode, our dominant mode, tends to ignore them. Moreover, our left hemisphere, educated as it is in our Western culture, tends not to challenge assumptions.

Here is how she suggests you might subjectively experience an Rmode

state of consciousness:

Let’s review the characteristics of the R-mode one more time. First, there is a seeming suspension of time. You are not aware of time in the sense of marking time. Second, you pay no attention to spoken words. You may hear the sounds of speech, but you do not decode the

sounds into meaningful words. If someone speaks to you, it seems

as though it would take a great effort to cross back, think again in words, and answer. Furthermore, whatever you are doing seems immensely interesting. You are attentive and concentrated and feel “at one” with the thing you are concentrating on. You feel energized

but calm, active without anxiety. You feel self-confident and capable of doing the task at hand. Your thinking is not in word but in images and, particularly while drawing, your thinking is “locked on” to the object you are perceiving. The state is very pleasurable. On leaving it, you do not feel tired, but refreshed.

Our job now is to bring this state into clearer focus and under greater conscious control, in order to take advantage of the right hemisphere’s superior ability to process visual information and to

increase your ability to make the cognitive shift to R-Mode at will.

2. Changing your physical self.

3. Calling upon your own resources.

The following eight steps are a guide to implementing the resource

strategy.

1. Establish the context that prevents you from responding appropriately (for example, being caught in a losing trade). Identify the trigger (words, tone, analogue, and so on) for the nonproductive state (regret, anger, bad self-talk). Identify a specific example of a situation

(perhaps the last bad trade).

2. Associate into the situation at the point when you first realize you are having the undesired response (for example, see the stock tick downward on your computer screen).

3. Dissociate from the situation (literally step back from the screen).

4. Identify the most appropriate response(s) for the “other you over there” (for example, reframe the trade from “good” to “bad”; become fearful of it becoming worse).

5. Reassociate back into the situation, taking with you the new responses.

6. Future-pace (see yourself in the future exiting bad positions).

7. Test using a different but similar situation to the one previously tested.

8. Identify the most appropriate response(s).

4. Fantasizing.

5. Analyzing and integrating parts of yourself.

6. Modeling yourself after others.

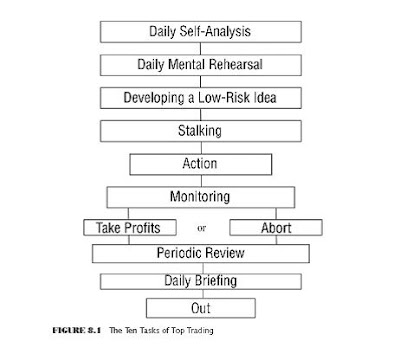

The Ten Tasks of Top Trading

1. Daily Self-Analysis Successful trading is 40% risk control and 60% self-control. In turn, the risk control portion is one half money management and one half market analysis. Thus, market analysis is only about 20% of successful trading.

1. Daily Self-Analysis Successful trading is 40% risk control and 60% self-control. In turn, the risk control portion is one half money management and one half market analysis. Thus, market analysis is only about 20% of successful trading.Numerous people find that their best trades are the hardest trades to take. You generally go against the crowd in the best trades. As a result, when most people believe you are wrong with enough conviction to be in the market, and you’re around a lot of them, it’s very hard to go against them. As a result, people who trade in a crowd perceive their good trades to be “hard

trades.” Let’s assume that for you the hard trades are the big winners. How do you know if a trade is hard, or whether you are simply not in the mood to trade? You don’t. Self-analysis allows you to distinguish between the “hard” trade and those times when you make the trade seem hard.

6. Monitoring,The worst mistake that one can make during the monitoring phase is to rationalize and distort data according to expectations. The purpose of monitoring the market is to pay attention to market signals. The trader who interprets signals according to his expectations is not performing this task adequately.

9. Daily Debriefing

• First, avoid self-recrimination—telling yourself that you “should have” done this or you “could have” done that. Instead, resolve not to repeat that mistake again.

• Second, replay the trade in your mind. Prior to making that mistake, you reached a choice point. At that choice point, you had a number of options available to you.

• Third, mentally go back in time to that choice point and review you options.

• Fourth, for each possible option, determine what the outcome would be if you had taken it. Be sure that you give yourself at least three good choices and mentally rehearse them. Some generals are known for fighting the strategies of the last war. Those who do usually lose the battle. Always give yourself as many choices as possible, so that you don’t get stuck with limited options or a forced choice.

• Fifth, once you’ve found at least three options with favorable outcomes, mentally rehearse carrying them out in the future when you encounter similar situations. Once you’ve practiced them in your mind, you will find that selecting one of them is easy when you encounter

a similar situation in the future.

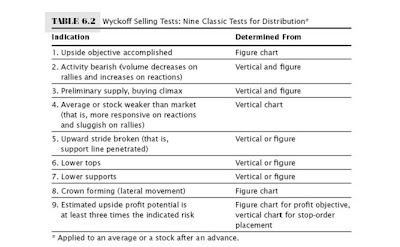

Distribution

THE ICE STORY

In Robert Evans’ ice story analogy, we imagine the market in the person of a Boy Scout walking

over a frozen river in the midst of winter. If support (the ice) is strong, the river covered with ice

has no difficulty in supporting the weight of the Boy Scout. That support is seen as a wiggly dashed line connecting the lows, the supports, in a TR. A failure by the Boy Scout to reach the upper resistance level of the TR would be a warning of potential weakness. Weakness of the ice would be signaled by the Boy Scout breaking support, or falling through the ice.

The Boy Scout has two chances to get back above the ice (that is, creating a bullish “spring” situation). On the first upward rally the Boy Scout may fail to regain a footing above the ice. If so,

he will sink lower into the river in order to gather strength to try and rally once more and crack

the ice. If on this second attempt the Boy Scout again fails to penetrate above the ice, he would most likely sink downward and drown. (That is, a bear market/markdown phase would occur.)

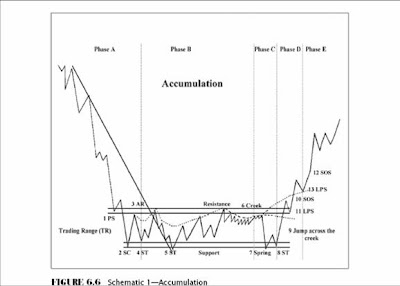

Accumulation

PS—preliminary support, where substantial buying begins to provide pronounced support after a prolonged down-move. Volume and spread widen and provide a signal that the down-move may be approaching its end.

PS—preliminary support, where substantial buying begins to provide pronounced support after a prolonged down-move. Volume and spread widen and provide a signal that the down-move may be approaching its end.SC—selling climax, the point at which widening spread and selling pressure usually climaxes and heavy or panicky selling by the public is being absorbed by larger professional interests at prices near a bottom.

AR—automatic rally, where selling pressure has been pretty much exhausted. A wave of buying can now easily push up prices, which is further fueled by short covering. The high of this rally will help define the top of the trading range.

ST—secondary test, revisiting the area of the selling climax to test the supply/demand balance at these price levels. If a bottom is to be confirmed, significant supply should not resurface, and volume and price spread should be significantly diminished as the market approaches support in the area of the SC. The “creek,” referring to the analogy described elsewhere in Chapter 6, is a wavy line of resistance drawn loosely across rally peaks within the trading range. There are, of course, minor lines of resistance and more significant ones that will have to be crossed before the market’s journey can continue onward and upward.

“Jump”—continuing the creek analogy, the point at which price jumps through the resistance line; a good sign if done on increasing spread and volume.

SOS—sign of strength, an advance on increasing spread and volume.

LPS—last point of support, the ending point of a reaction or pullback at which support was met. Backing up to an LPS means a pullback to support that was formerly resistance, on diminished spread and volume after an SOS. This is a good place to initiate long positions or to add to profitable ones.

Phase A In phase A, supply has been dominant and it appears that finally the exhaustion of supply is becoming evident. The approaching exhaustion of supply or selling is evidenced in preliminary support (PS) and the selling climax (SC) where a widening spread often climaxes and where heavy volume or panicky selling by the public is being absorbed by larger professional interests. Once these intense selling pressures have been expressed, an automatic rally (AR) follows the selling climax. A successful secondary test on the downside shows less selling than on

the SC and with a narrowing of spread and decreased volume. A successful secondary test (ST) should stop around the same price level as the selling climax. The lows of the SC and the ST and the high of the AR set the boundaries of the TR. Horizontal lines may be drawn to help focus attention on market behavior.

It is possible that phase A will not include a dramatic expansion in spread and volume. However, it is better if it does, because the more dramatic selling will clear out more of the sellers and pave

the way for a more pronounced and sustained markup.

Where a TR represents a reaccumulation (a TR within a continuing up-move), you will not have evidence of PS, SC, and ST as illustrated in phase A of Figure 6.6. Instead, phase A will look more like phase A of the basic Wyckoff distribution. Nonetheless, phase A still represents the area where the stopping of the previous trend occurs. Trading range phases B through E generally unfold in the same manner as within an initial base area of accumulation.

Phase B The function of phase B is to build a cause in preparation for the next effect. In phase B, supply and demand are for the most part in equilibrium and there is no decisive trend.

Although clues to the future course of the market are usually more mixed and elusive, some useful generalizations can be made.

In the early stages of phase B, the price swings tend to be rather wide, and volume is usually greater and more erratic. As the TR unfolds, supply becomes weaker and demand stronger as professionals are absorbing supply. The closer you get to the end or to leaving the TR, the more volume tends to diminish. Support and resistance lines (shown as horizontal lines in Figure 6.6)

usually contain the price action in phase B and will help define the testing process that is to come in phase C. The penetrations or lack of penetrations of the TR enable us to judge the quantity and quality of supply and demand.

Phase C In phase C, the stock goes through testing. It is during this testing phase that the smart money operators ascertain whether the stock is ready to enter the markup phase. The stock may begin to come out of the TR on the upside with higher tops and bottoms or it may go through a downside spring or shakeout by first breaking previous supports before the upward climb begins. This latter test is preferred by traders because it does a better job of cleaning out the remaining supply of weak holders and creates a false impression as to the direction of

the ultimate move. Phase C in Figure 6.6 shows an example of this latter alternative.

A spring is a price move below the support level of a trading range that quickly reverses and moves back into the range. It is an example of a bear trap because the drop below support appears to signal resumption of the downtrend. In reality, though, the drop marks the end of the downtrend, thus trapping the late sellers, or bears. The extent of supply, or the strength of the sellers, can be judged by the depth of the price move to new lows and the relative level of volume in that penetration.

Until this testing process, you cannot be sure the TR is accumulation and hence you must wait to take a position until there is sufficient evidence that markup is about to begin. If we have waited and followed the unfolding TR closely, we have arrived at the point where we can be quite confident of the probable upward move. With supply apparently exhausted and our danger point pinpointed, our likelihood of success is good and our reward/risk ratio favorable.

The shakeout at point 7 in Figure 6.6 represents our first prescribed place to initiate a long position. The secondary test at point 8 is an even better spot to buy, since a low volume pullback and a specific low-risk stop or danger point at point 7 gives us greater evidence and more confidence to act. A sign of strength (SOS)/ jump across the creek (point 9) shifts the trading range into phase D.

Phase D If we are correct in our analysis and our timing, what should follow now is the consistent dominance of demand over supply as evidenced by a pattern of advances (SOSs) on widening price spreads and increasing volume, and reactions (LPSs) on smaller spreads and diminished volumes. If this pattern does not occur, then we are advised not to add to our position but to look to close out our original position and remain on the sidelines until we have more conclusive evidence that the markup is beginning. If the markup of your stock progresses as described to this point, then you’ll have additional opportunities to add to your position.

Your aim here must be to initiate a position or add to your position as the stock or commodity is about to leave the TR. At this point, the force of accumulation has built a good potential as

measured by the Wyckoff point-and-figure method.

Thus you have waited until this point to initiate or add to your position and by doing so you have enhanced the likelihood of success and maximized the use of your trading capital. In schematic 1, this opportunity comes at point 11 on the “pullback to support” after “jumping resistance”

(in Wyckoff terms this is known as “backing up to the edge of the creek” after “jumping across the creek”). Another similar opportunity comes at point 13, a more important last point of support (LPS).

In phase D, the markup phase blossoms as professionals begin to move into the stock. It is here that our best opportunities to add to our positionexist, just as the stock leaves the TR.

Phase E In phase E, the stock leaves the TR and demand is in control. Setbacks are unpronounced and short-lived. Having taken your positions, your job is to monitor the stock’s progress as it works out its force of accumulation. At each of points 7, 8, 11, and 13 you may enter trading take positions on the long side and use point-and-figure counts from these

points to calculate price projections that will help you to determine your reward/risk prior to establishing your speculative position. These projections will also be useful later in helping to target areas for closing or adjusting your position.

Remember that schematic 1 shows us just one idealized model or anatomy of a TR encompassing the accumulation process. There are many variations of this accumulation anatomy. The presence of a Wyckoff principle like a selling climax (SC) doesn’t confirm that accumulation is

occurring in the TR, but it does strengthen the case for it. However, it may

be accumulation, redistribution, or nothing. The use of Wyckoff principles and phases identifies and defines some of the key considerations for evaluating most trading ranges and helps us determine whether it is supply or demand that is becoming dominant and when the stock appears ready to leave the trading range.

The Nine Classic Tests for Accumulation

As you approach this case of nine classic buying tests, you ought to keep in mind the following admonitions from Lefèvre’s Reminiscences of a Stock Operator:

This experience has been the experience of so many traders so many times that I can give this rule: In a narrow market, when prices are not getting anywhere to speak of but move within a narrow range, there is no sense in trying to anticipate what the next big movement is going to be—up or down. The thing to do is to watch the market, read the tape to determine the limits of the get-nowhere prices, and make up your mind that you will not take an interest until the price

breaks through the limit in either direction. A speculator must concern himself with making money out of the market and not with insisting that the tape must agree with him.

Therefore, the thing to determine is the speculative line of least resistance at the moment of trading; and what he should wait for is the moment when that line defines itself, because that is his signal to get busy.

Three Fundamental Laws

1. The law of supply and demand determines the price direction. When demand is greater than supply, prices will rise, and when supply is greater than demand, prices will fall. Using a bar chart, the traderanalyst can study the relationship between supply and demand by

monitoring price and volume over time.

2. The law of cause and effect provides an insight into the extent of the coming price move up or down. In order to have an effect you must first have a cause; the effect will be in proportion to the cause. This law’s operation can be seen as the force of accumulation or distribution within a

trading range—and how this force works itself out in a subsequent trend or movement out of that trading range. Point-and-figure chart counts are used to measure a cause and to project the extent of its effect.

3. The law of effort versus result provides an early-warning indication of a forthcoming possible change in trend. Disharmonies and divergences between volume and price often signal a change in the direction of a price trend. The Wyckoff Optimism/Pessimism Index is an on-balance volume type of indicator helpful for identifying accumulation versus distribution, thereby gauging effort.

Taken together, these three Wyckoff laws shed light on the intentions of the smart money, the Composite Man. The law of cause and effect reveals the extent of preparation of the subsequent campaign to be conducted by the Composite Man, while the loss of supply indicates the Composite Man’s intentions to carry out the campaign now to the upside or the downside. Anticipation of the direction of the movement out of the sideways area of preparation is often foreshadowed by the divergences or disharmonies that define the law of effort versus result. The power available to the trader that results from these three laws acting in concert is demonstrated in the next section.

HOW TO INTERPRET WYCKOFF P&F CHARTS

The procedures for the interpretation of the Wyckoff-oriented point-andfigure chart are listed below, outlined as six steps.

Start with a bar chart and a point-and-figure (P&F) chart covering the same patterns and time. Wyckoff prefers the one-point reversal chart—for example, the DJIA blocked in boxes of 100 points each. But Wyckoff insists that at least two entries must appear in each and every column. That leads to occasionally combining X’s and O’s or up and down price movements to meet the minimum standard of two entries per column.

The box size is important. For the DJIA the Wyckoff/Stock Market Instituteuses 50 and 100 points. Please note that those are generated by the actual tape prints within a day. Hence, a very volatile day may produce many point-and-figure ups and downs.

1. Use the bar chart to identify one, or usually two or three, potential reversal patterns—for example, an inverse “head-and-shoulders” (H&S) bottom followed by a “cup-and-handle” on the same chart.

2. The point-and-figure count will be taken from the right shoulder or from the handle identified on the bar chart—in other words, from the last pullback before the price advance or markup stage.

3. On the P&F chart count the number of boxes across the accumulation formation (for example, inverse head-and-shoulders, from shoulder to shoulder).

4. Count the number of boxes (columns) and multiply that number by the value found in each box (for example, 50 points). Note that although some columns may have only two boxes, one after the other, and other columns contain several boxes, the same per box value applies. In our case, the 2002–2003 bottom had 72 boxes (columns) each worth 100 points, for a total of 7,200 points.

5. Add the total count to the lowest price on the P&F chart itself and to the count line itself. Thus, in the 2002–2003 example 7,200 points were added to the low price (the “head” of the inverse head-and-shoulders of 7,200) for an upside projection of 14,400.

6. Conservative is the guiding principle. Project the minimum pricefirst; use the minimum projection to estimate the reward-to-risk ratio.

Start with a bar chart and a point-and-figure (P&F) chart covering the same patterns and time. Wyckoff prefers the one-point reversal chart—for example, the DJIA blocked in boxes of 100 points each. But Wyckoff insists that at least two entries must appear in each and every column. That leads to occasionally combining X’s and O’s or up and down price movements to meet the minimum standard of two entries per column.

The box size is important. For the DJIA the Wyckoff/Stock Market Instituteuses 50 and 100 points. Please note that those are generated by the actual tape prints within a day. Hence, a very volatile day may produce many point-and-figure ups and downs.

1. Use the bar chart to identify one, or usually two or three, potential reversal patterns—for example, an inverse “head-and-shoulders” (H&S) bottom followed by a “cup-and-handle” on the same chart.

2. The point-and-figure count will be taken from the right shoulder or from the handle identified on the bar chart—in other words, from the last pullback before the price advance or markup stage.

3. On the P&F chart count the number of boxes across the accumulation formation (for example, inverse head-and-shoulders, from shoulder to shoulder).

4. Count the number of boxes (columns) and multiply that number by the value found in each box (for example, 50 points). Note that although some columns may have only two boxes, one after the other, and other columns contain several boxes, the same per box value applies. In our case, the 2002–2003 bottom had 72 boxes (columns) each worth 100 points, for a total of 7,200 points.

5. Add the total count to the lowest price on the P&F chart itself and to the count line itself. Thus, in the 2002–2003 example 7,200 points were added to the low price (the “head” of the inverse head-and-shoulders of 7,200) for an upside projection of 14,400.

6. Conservative is the guiding principle. Project the minimum pricefirst; use the minimum projection to estimate the reward-to-risk ratio.

Composite Man

In studying, understanding, and interpreting market action, we consider all market action as a manufactured operation in which the buying and/or selling is sufficiently centered and coming from interests better informed than the generally untrained individual investor/speculator. The many large interests which do have an effect on the market place (trust companies, banks, mutual funds, investment trusts, investment companies, hedge funds, specialists, position brokers, etc.) are best thought of as the Composite Man.

This Composite Man causes the market to act and react. Or, what actually happens is the market responds to the ageless, natural law of supply and demand. The Composite Man and the effects of the law of supply and demand are really synonymous. It is the result of the motives, objectives, hopes, and fears of all the buyers and sellers whose actions produce the net effect upon the market. Other terms which may be thought to be synonymous with the Composite Man would be “the market,” “the sponsor,” “the operator,” or “they.” These terms are used interchangeably. . . . The selection of the terms is determined by what is most meaningful to the student. It should be your objective to think of the Composite Man as the primary force in the market place. Thinking of him in this light should enhance your analysis of the action resulting from the dominant groups operating within individual stocks and their total effect within the general market place.2

The Wyckoff method

The Wyckoff method is a five-step method of market analysis.

1. Determine the present position and probable future trend of the market. Then decide how you are going to play the game. Use bar charts and point-and-figure charts of market index.

2. Select stocks in harmony with the trend. If you are playing the game long, select stocks which you believe are stronger than the market. If you are not sure about an individual issue, drop it. Use bar charts of individual stocks.

3. Select stocks with cause that equals or exceeds minimum objective. Choose stocks that are under accumulation or reaccumulation. Use point-and-figure charts of individual stocks.

4. Determine the stocks’ readiness to move. Rank stocks in order of your preference. Use bar charts and point-and-figure charts of individual stocks.

5. Time your commitment with a turn in the stock market index. Put your stop-loss in place and relax. Then follow through, until you close out the market position. Use bar charts.

The Wyckoff method has stood the test of time. Over 100 years of continuous development and usage have proven the value of the Wyckoff method for use with stocks, bonds, currencies, and commodities around the globe. This accomplishment should come as no surprise because, as the Wyckoff method reveals the “real rules of the game.”

Before you can master the Wyckoff method, you must firmly embrace the fact that it is a judgmental method. To gain skill in making judgments, the trader needs experience in a variety of different case situations steered by accurate and intelligent guidelines. Remember,the market is more organic than mechanistic, and the artistry applied by the technical trader is important. Nonetheless, this five-step procedure can help the technical trader orient his thinking and organize his learning.

1. Determine the present position and probable future trend of the market. Then decide how you are going to play the game. Use bar charts and point-and-figure charts of market index.

2. Select stocks in harmony with the trend. If you are playing the game long, select stocks which you believe are stronger than the market. If you are not sure about an individual issue, drop it. Use bar charts of individual stocks.

3. Select stocks with cause that equals or exceeds minimum objective. Choose stocks that are under accumulation or reaccumulation. Use point-and-figure charts of individual stocks.

4. Determine the stocks’ readiness to move. Rank stocks in order of your preference. Use bar charts and point-and-figure charts of individual stocks.

5. Time your commitment with a turn in the stock market index. Put your stop-loss in place and relax. Then follow through, until you close out the market position. Use bar charts.

The Wyckoff method has stood the test of time. Over 100 years of continuous development and usage have proven the value of the Wyckoff method for use with stocks, bonds, currencies, and commodities around the globe. This accomplishment should come as no surprise because, as the Wyckoff method reveals the “real rules of the game.”

Before you can master the Wyckoff method, you must firmly embrace the fact that it is a judgmental method. To gain skill in making judgments, the trader needs experience in a variety of different case situations steered by accurate and intelligent guidelines. Remember,the market is more organic than mechanistic, and the artistry applied by the technical trader is important. Nonetheless, this five-step procedure can help the technical trader orient his thinking and organize his learning.

Thursday, May 8, 2008

Wednesday, May 7, 2008

PotentialSG Market Trading List

Asia Env technical turn bullish with good risk reward ratio.

Long at 0.48

Stop Loss at 0.44

Min first Target 0.55

Next Target 0.60

Long at 0.48

Stop Loss at 0.44

Min first Target 0.55

Next Target 0.60

Tuesday, May 6, 2008

Subscribe to:

Posts (Atom)