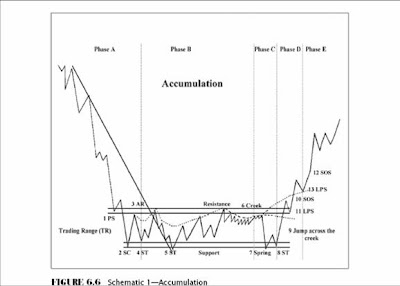

PS—preliminary support, where substantial buying begins to provide pronounced support after a prolonged down-move. Volume and spread widen and provide a signal that the down-move may be approaching its end.

PS—preliminary support, where substantial buying begins to provide pronounced support after a prolonged down-move. Volume and spread widen and provide a signal that the down-move may be approaching its end.SC—selling climax, the point at which widening spread and selling pressure usually climaxes and heavy or panicky selling by the public is being absorbed by larger professional interests at prices near a bottom.

AR—automatic rally, where selling pressure has been pretty much exhausted. A wave of buying can now easily push up prices, which is further fueled by short covering. The high of this rally will help define the top of the trading range.

ST—secondary test, revisiting the area of the selling climax to test the supply/demand balance at these price levels. If a bottom is to be confirmed, significant supply should not resurface, and volume and price spread should be significantly diminished as the market approaches support in the area of the SC. The “creek,” referring to the analogy described elsewhere in Chapter 6, is a wavy line of resistance drawn loosely across rally peaks within the trading range. There are, of course, minor lines of resistance and more significant ones that will have to be crossed before the market’s journey can continue onward and upward.

“Jump”—continuing the creek analogy, the point at which price jumps through the resistance line; a good sign if done on increasing spread and volume.

SOS—sign of strength, an advance on increasing spread and volume.

LPS—last point of support, the ending point of a reaction or pullback at which support was met. Backing up to an LPS means a pullback to support that was formerly resistance, on diminished spread and volume after an SOS. This is a good place to initiate long positions or to add to profitable ones.

Phase A In phase A, supply has been dominant and it appears that finally the exhaustion of supply is becoming evident. The approaching exhaustion of supply or selling is evidenced in preliminary support (PS) and the selling climax (SC) where a widening spread often climaxes and where heavy volume or panicky selling by the public is being absorbed by larger professional interests. Once these intense selling pressures have been expressed, an automatic rally (AR) follows the selling climax. A successful secondary test on the downside shows less selling than on

the SC and with a narrowing of spread and decreased volume. A successful secondary test (ST) should stop around the same price level as the selling climax. The lows of the SC and the ST and the high of the AR set the boundaries of the TR. Horizontal lines may be drawn to help focus attention on market behavior.

It is possible that phase A will not include a dramatic expansion in spread and volume. However, it is better if it does, because the more dramatic selling will clear out more of the sellers and pave

the way for a more pronounced and sustained markup.

Where a TR represents a reaccumulation (a TR within a continuing up-move), you will not have evidence of PS, SC, and ST as illustrated in phase A of Figure 6.6. Instead, phase A will look more like phase A of the basic Wyckoff distribution. Nonetheless, phase A still represents the area where the stopping of the previous trend occurs. Trading range phases B through E generally unfold in the same manner as within an initial base area of accumulation.

Phase B The function of phase B is to build a cause in preparation for the next effect. In phase B, supply and demand are for the most part in equilibrium and there is no decisive trend.

Although clues to the future course of the market are usually more mixed and elusive, some useful generalizations can be made.

In the early stages of phase B, the price swings tend to be rather wide, and volume is usually greater and more erratic. As the TR unfolds, supply becomes weaker and demand stronger as professionals are absorbing supply. The closer you get to the end or to leaving the TR, the more volume tends to diminish. Support and resistance lines (shown as horizontal lines in Figure 6.6)

usually contain the price action in phase B and will help define the testing process that is to come in phase C. The penetrations or lack of penetrations of the TR enable us to judge the quantity and quality of supply and demand.

Phase C In phase C, the stock goes through testing. It is during this testing phase that the smart money operators ascertain whether the stock is ready to enter the markup phase. The stock may begin to come out of the TR on the upside with higher tops and bottoms or it may go through a downside spring or shakeout by first breaking previous supports before the upward climb begins. This latter test is preferred by traders because it does a better job of cleaning out the remaining supply of weak holders and creates a false impression as to the direction of

the ultimate move. Phase C in Figure 6.6 shows an example of this latter alternative.

A spring is a price move below the support level of a trading range that quickly reverses and moves back into the range. It is an example of a bear trap because the drop below support appears to signal resumption of the downtrend. In reality, though, the drop marks the end of the downtrend, thus trapping the late sellers, or bears. The extent of supply, or the strength of the sellers, can be judged by the depth of the price move to new lows and the relative level of volume in that penetration.

Until this testing process, you cannot be sure the TR is accumulation and hence you must wait to take a position until there is sufficient evidence that markup is about to begin. If we have waited and followed the unfolding TR closely, we have arrived at the point where we can be quite confident of the probable upward move. With supply apparently exhausted and our danger point pinpointed, our likelihood of success is good and our reward/risk ratio favorable.

The shakeout at point 7 in Figure 6.6 represents our first prescribed place to initiate a long position. The secondary test at point 8 is an even better spot to buy, since a low volume pullback and a specific low-risk stop or danger point at point 7 gives us greater evidence and more confidence to act. A sign of strength (SOS)/ jump across the creek (point 9) shifts the trading range into phase D.

Phase D If we are correct in our analysis and our timing, what should follow now is the consistent dominance of demand over supply as evidenced by a pattern of advances (SOSs) on widening price spreads and increasing volume, and reactions (LPSs) on smaller spreads and diminished volumes. If this pattern does not occur, then we are advised not to add to our position but to look to close out our original position and remain on the sidelines until we have more conclusive evidence that the markup is beginning. If the markup of your stock progresses as described to this point, then you’ll have additional opportunities to add to your position.

Your aim here must be to initiate a position or add to your position as the stock or commodity is about to leave the TR. At this point, the force of accumulation has built a good potential as

measured by the Wyckoff point-and-figure method.

Thus you have waited until this point to initiate or add to your position and by doing so you have enhanced the likelihood of success and maximized the use of your trading capital. In schematic 1, this opportunity comes at point 11 on the “pullback to support” after “jumping resistance”

(in Wyckoff terms this is known as “backing up to the edge of the creek” after “jumping across the creek”). Another similar opportunity comes at point 13, a more important last point of support (LPS).

In phase D, the markup phase blossoms as professionals begin to move into the stock. It is here that our best opportunities to add to our positionexist, just as the stock leaves the TR.

Phase E In phase E, the stock leaves the TR and demand is in control. Setbacks are unpronounced and short-lived. Having taken your positions, your job is to monitor the stock’s progress as it works out its force of accumulation. At each of points 7, 8, 11, and 13 you may enter trading take positions on the long side and use point-and-figure counts from these

points to calculate price projections that will help you to determine your reward/risk prior to establishing your speculative position. These projections will also be useful later in helping to target areas for closing or adjusting your position.

Remember that schematic 1 shows us just one idealized model or anatomy of a TR encompassing the accumulation process. There are many variations of this accumulation anatomy. The presence of a Wyckoff principle like a selling climax (SC) doesn’t confirm that accumulation is

occurring in the TR, but it does strengthen the case for it. However, it may

be accumulation, redistribution, or nothing. The use of Wyckoff principles and phases identifies and defines some of the key considerations for evaluating most trading ranges and helps us determine whether it is supply or demand that is becoming dominant and when the stock appears ready to leave the trading range.

No comments:

Post a Comment